January 31, 2018

To the Editor:

Your lead article in January’s edition is misleading in one important respect. While it is true that the limitation of the SALT deduction to $10,000 disproportionately affects high-income taxpayers in high tax states, like New York, New Jersey and Connecticut, the same Tax Reform Act eliminated the AMT (Alternative Minimum TAX), disproportionately benefiting those same taxpayers. The net effect if any therefore is much less than envisioned in your article. The AMT elimination should substantially mitigate the effects of the SALT reduction on Westchester real estate prices.

Fred Salek

Tarrytown

Editor’s Note: While the writer is correct that the new tax law raises the threshold for the Alternative Minimum Tax (AMT), thus mitigating the effects of the elimination of SALT deductions for high income earners, it is our understanding that it does not affect those with modest incomes who happen to live in homes that have increased in value–hence in their assessments. There are homeowners of modest incomes along the side streets of Irvington, for example, whose property tax bills have doubled this past year while their incomes have remained unchanged. They’re the ones who will suffer for lack of a SALT deduction.

Read or leave a comment on this story...

April 18, 2024

The Board of Directors of Abbott House has named Ms. Justine Christakos as incoming CEO and President of Abbott House,...

Read More

April 18, 2024

By Rick Pezzullo--- The Ardsley Board of Education has appointed Dr. Vidya Bhat as the incoming full-time probationary principal of...

Read More

April 17, 2024

By Rick Pezzullo--- Ciara Lyons and Hanna Reich are heads of the Class of 2024 at Irvington High School. Lyons...

Read More

April 15, 2024

By Barrett Seaman-- The ongoing centennial celebration of the founding of the Irvington Girl Scouts wound its way on Sunday,...

Read More

April 15, 2024

by Janine Annett-- Robert Simmonds has deep roots in Hastings. Not only is he a lifelong resident of the village,...

Read More

April 15, 2024

WRITER'S BLOCK...OF CLAY: The pleasure, pain and Play-Doh of creating By Krista Madsen– There have been times in my writing life—memorable, magical,...

Read More

April 12, 2024

By Barrett Seaman— The U.S. Department of Justice this week filed a False Claim complaint against Tarrytown-based Regeneron Pharmaceuticals, claiming...

Read More

April 11, 2024

By Rick Pezzullo--- The Public Schools of the Tarrytowns will be hosting the 2024 Sleepy Hollow Jazz Festival on Friday,...

Read More

April 10, 2024

We've got great news for the health of our local forests! An anonymous donor granted $100,000 to Westchester Land Trust...

Read More

April 10, 2024

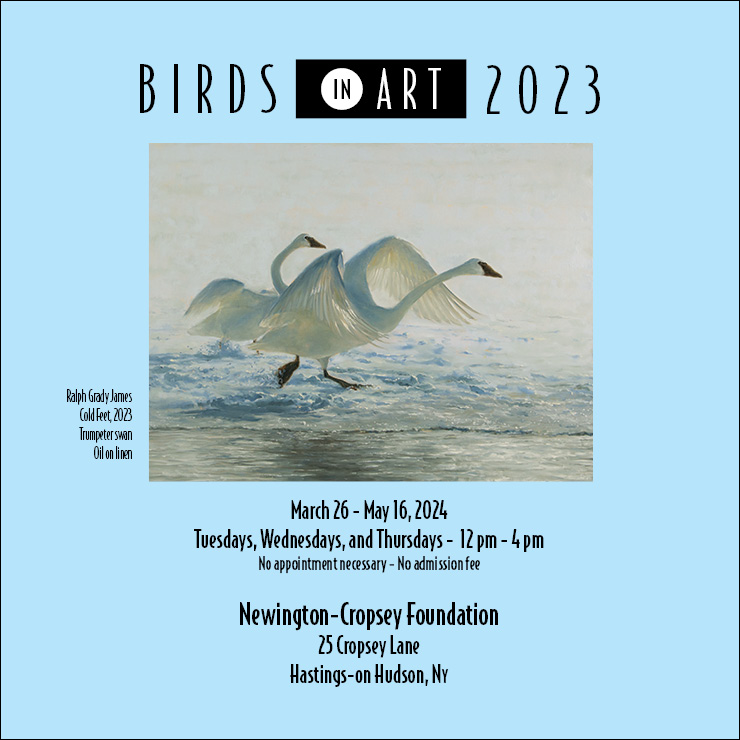

This story is from the Rivertowns Current by Janine Annett-- Rivertowns residents don’t have to travel down to Brooklyn...

Read More

Print

Print